New numbers are out reporting real estate home price insights for August 2018. Nationwide, home prices which include distressed sales, increased from August 2017 by 5.5 percent. August home values also increased from July 2018 by 0.1 percent. These numbers are provided by CoreLogic and incorporates public records and newly released public data.

“August had the slowest appreciation in nearly two years.”

Frank Nothaft, Chief Economist at CoreLogic says, “The rise in mortgage rates this summer to their highest level in seven years has made it more difficult for potential buyers to afford a home. The slackening in demand is reflected in the slowing of national appreciation, as illustrated in the CoreLogic Home Price Index. National appreciation in August was the slowest in nearly two years, and we expect appreciation to slow further in the coming year.”

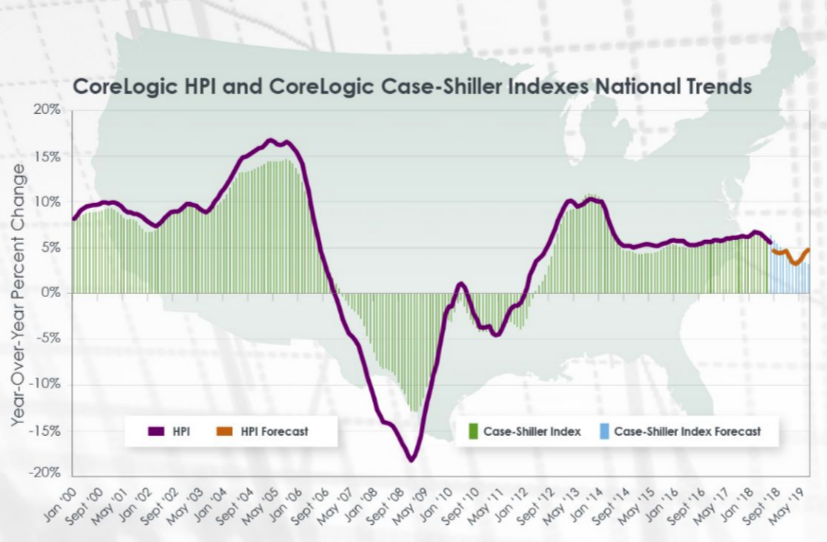

This graph shows a comparison of the national year-over-year percent change for the CoreLogic HPI and CoreLogic Case-Shiller Index from 2000 to present month with forecasts one year into the future. Note that both the CoreLogic HPI Single Family Combined tier and the CoreLogic Case-Shiller Index are posting positive, but moderating year-over-year percent changes, and forecasting gains for the next year.

In 2018, CoreLogic together with RTi Research of Norwalk, Connecticut, conducted an extensive consumer housing sentiment study, combining consumer and property insights. The study assessed attitudes toward homeownership and the drivers of the home buying or renting decision process. August data indicates that, while home prices are cooling, they are still rising in most markets. Home sales are down in some metros, in part because sellers believe prices will continue to rise and that by waiting, they can sell their homes for a better price. Many intend to use proceeds from the sale of their current home to fund the down payment of their next home. Sixty-six percent of homeowners who are considering buying in the next 10 years will need to sell their current homes to finance their next one. Meanwhile, 35 percent of recent homebuyers said they used funds from the sale of their previous home to finance the down payment of their current home.

“Homeowners continue to wait out the market for a greater return on their investment.”

President and CEO of CoreLogic, Frank Martell says, “In some markets, homebuyers and sellers are remaining cautious and taking a pause as price appreciation continues to rise. By waiting to sell, homeowners believe they will get the greatest return on their investment; the more money they have for a down payment, the easier the purchase payments will be for their next home.”

As for South Carolina, our year-over-year change in home values between August 2017 and August 2018 is at 5.0 percent with predictions for August 2019 of 5.6 percent. However, our month-over-month has stayed even at 0.3 percent.

Our closest metro area of Washington, D.C. is at 2.9 percent for August 2018. While Miami, FL is a bit higher at 3.5 percent. The markets in both these metro areas are more volatile than in Greenville, SC so market fluctuations will affect them more. When looking at the Market Condition Indicators map it is showing Greenville metro area as overvalued as of August 2018 while showing Spartanburg to our north as normal.

So, what does this mean for potential buyers and sellers in Greenville? If you plan on selling your home, contact me today so I can get you a current market value. With interest rates continuing to rise it will only make the buyer pool smaller as the ability for buyers to qualify for more expensive homes lessens. Conversely, buyers need to get into a home as soon as possible this year. Inventory is already low, inflation is under control for now, but interest rates will continue rising through the end of this year. Buyers and Sellers, don’t wait until you get priced out of the market.

And remember if you, a friend or family member need assistance with selling or buying a home I can help. Referrals and people needing relocation assistance are welcome! Search Single Family homes in Greenville. Search Condos and Townhomes in Greenville.