Due to COVID and the lock down of our country, a lot of homeowners were put in a situation not of their making where they were suddenly households without income and without jobs. You may be thinking that 2021 will bring along a foreclosure crisis but that may not be the case. But realty is that plans were put in place through forbearance to ensure that history does not repeat itself.

In 2020, homeowners can request 180 days of mortgage relief through the forbearance. Once that expires, they can also request an additional 180 days which makes their total 360 days available. As these forbearances expire, homeowners need to stay in touch with their lenders so that together they can create a plan for repaying the deferred payments. There are multiple options that homeowners can pursue and with the right planning ending in foreclosure does not need to be the end.

One myth is that you must pay back the deferred payments in a lump sum at the end of the forbearance. But that is not the case. Fannie Mae states:

“You don’t have to repay the forbearance amount all at once upon completion of your forbearance plan… Here’s the important thing to remember: if you receive a forbearance plan, you will have options when it comes to repaying the missed amount. You don’t have to pay the forbearance amount at once unless you are able to do so.”

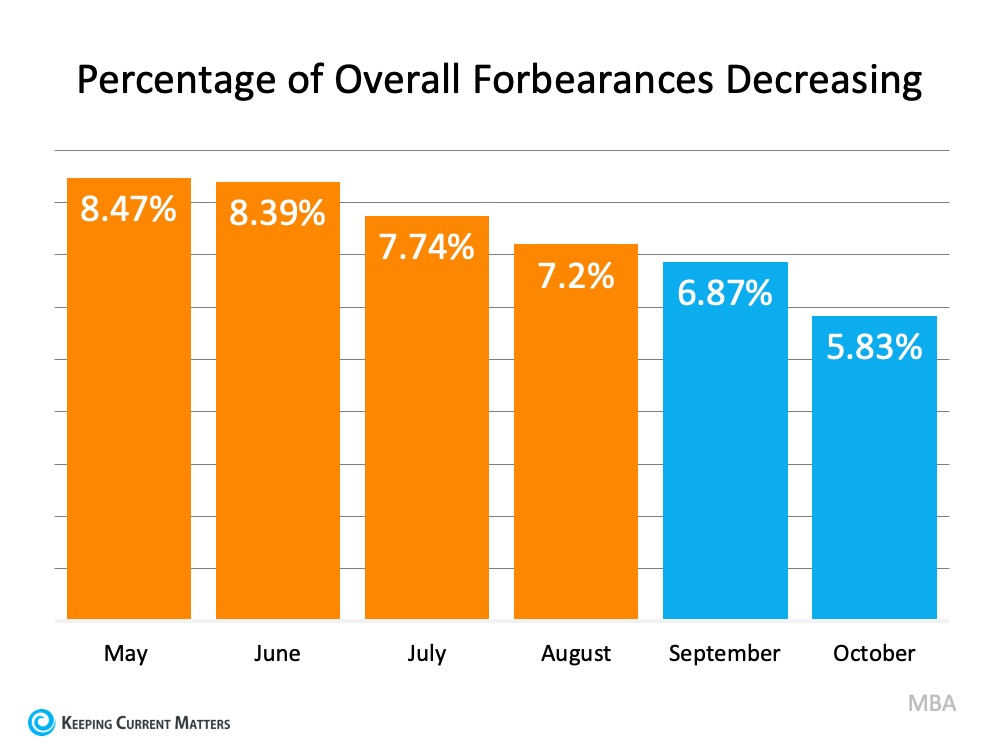

If we look at the total number of people in forbearance, we can see that the number has been decreasing steadily since people have been able to go back to work. Fewer people than first expected are in actual forbearance, so the number of homeowners is declining.

Good news is that there is less and less homeowners facing foreclosure. And a lot of those who applied for forbearance did not actually need it. Mike Fratantoni, Senior Vice President and Chief Economist at the Mortgage Bankers Association (MBA), stated:

“Nearly two-thirds of borrowers who exited forbearance remained current on their payments, repaid their forborne payments, or moved into a payment deferral plan. All of these borrowers have been able to resume – or continue – their pre-pandemic monthly payments.”

For those who are still in forbearance but unable to make payments, their option is to go ahead and sell their home. CoreLogic has stated that:

In the second quarter of 2020, the average homeowner gained approximately $9,800 in their equity during the past year.”

Selling their home and thus protecting their overall financial investment may be a good option for many homeowners in trouble. As Ivy Zelman, Founder of Zelman & Associates mentioned in a recent podcast:

“The likelihood of us having a foreclosure crisis again is about zero percent.”

What you should do? Reach out to your lender, discuss ways to avoid foreclosure and if you just can’t come to a solution, then reach out to me and I will help you get your home listed and sold so you can rest easy until your situation can improve.

Real Estate News

The housing market is playing a leading role in the economic recovery in the U.S. right now. Today’s high buyer demand and low housing inventory has caused housing prices to appreciate at an above-average pace. Historically low mortgage rates are a major driver for this demand. In South Carolina, the economic impact of a home sale is $73,000. When a home is sold not only does the seller make money but so does the surrounding economy. Basically, anyone who had a hand in the transaction makes something. That includes agents, home inspectors, title companies, lenders, WDO Inspectors, surveyors and a whole host of people who assist in closing a real estate transaction.

Local Greenville SC News

A specialty food store and café in downtown Greenville name Reid’s Fine Foods has opened. The owner had second thoughts about his timing but after seeing the response on opening day he is feeling excited. This is their fifth location and the first one outside of North Carolina. He is planning another store in Greenville, looking at Mt. Pleasant and Atlanta, GA. Reid’s took over the 4,600 sq. ft. space left vacant by Caviar & Bananas that closed in January. Their offerings include fine wine, a deli case of scratch-made salads, proteins and a made-to-order sandwich and salad counter. They also offer a meat case, cheeses, a wine bar and coffee bar and a dine-in café. They will offer local and regional products as well as private label products. The café will serve breakfast and dinner every day with brunch on Sundays. Stop by and support your local economy and give them a try! Then let me know what you think!

People are on the move and I am ready to help you buy or sell in the Greenville area. Please contact Victoria Cottle by email thevictoriacottlegroup@gmail.com or call (864) 275-3953 for your real estate needs in the Upstate of South Carolina!

Victoria Cottle is a Realtor® in the Greenville South Carolina area and if you, a friend, or a family member need assistance with selling or buying a home I can help. Referrals and people needing relocation assistance are welcome! Search Single Family homes in Greenville. Search Condos and Townhomes in Greenville.